Payments

Outside of Fintech, I’d expect pool of people who think payment systems are interesting to be quite small. That’s ok, it’s definitely not a topic for everyone. The below is a collection of notes and resources I’ve pulled together. Patrick’s blog Bits about Money is also an interesting read if you feel so inclined.

Payment systems ARE a network of networks

These networks transport messages that are instruction sets.

Payments rail: an individual payment network or platform that moves money from a payer to a payee.

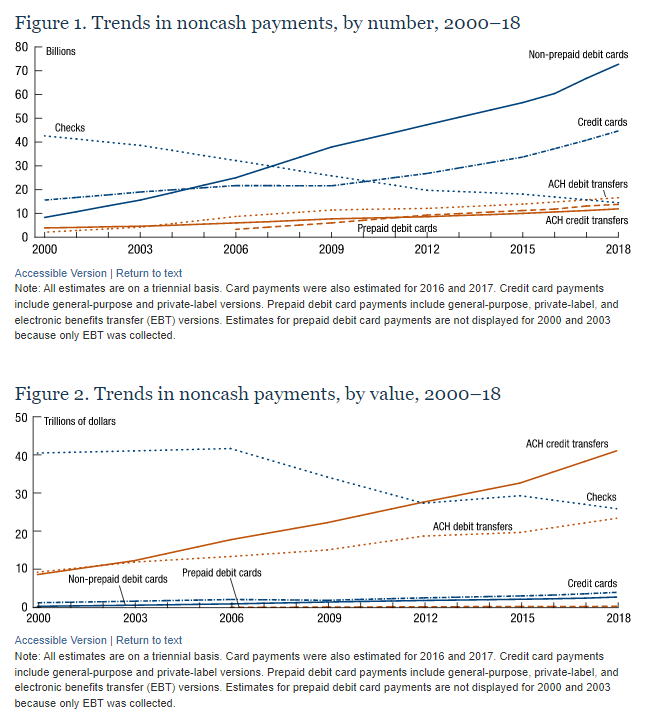

- Dominant payment rails in the US: | ACH | Payment Cards | Wire |

- Growing/emerging payment rails: | RTP | Mobile Payments (ex. Paypal) | Blockchain |

- Declining payment rail | Checks |

Overall industry trends moving towards faster payments. Interoperability across systems becoming more important.

Retail vs. Wholesale payment systems

- Retail Payments: generally refer to B2C and P2P type transactions.

- Largest percentage of all payments by count, smallest by dollar value

- Non-cash payments are processed across a variety of systems: check clearing systems, ACH, credit and debit card networks, payment networks (Paypal, Square, etc.)

- Almost all non-cash payment instruments settle electronically

- Wholesale Payments: generally refer to settlement activity between interbank transactions on very large payments => typically initiated by government agencies, institutional banks, very large corporations, etc.

- Smallest percentage of all payments by count, largest by dollar value.

- Main arteries of the country’s economy

- Two large-value electronic funds transfer systems settle the bulk of all payments by dollar value, in the US => CHIPS & Fedwire.

- Also referred to as Large-Value Payments Systems (LVPS)

- Also see National Settlement Service (NSS)

Federal Reserve Data

Federal Reserve Payments Study (FRPS)

Quantifies aggregate payment volumes in the US. (about FRPS)

FedNotes - Consumer Payment Choice

Report on US consumer payment preferences