Economy - Key Metrics

This page shows twelve economic indicators that are actively watched by investors to assess the general economic health of the US.

If interested in going a little deeper the Beige Book can be reviewed. It is issued by the Federal Reserve eight times a year and summarizes the general current economic conditions in each of the Fed’s twelve districts.

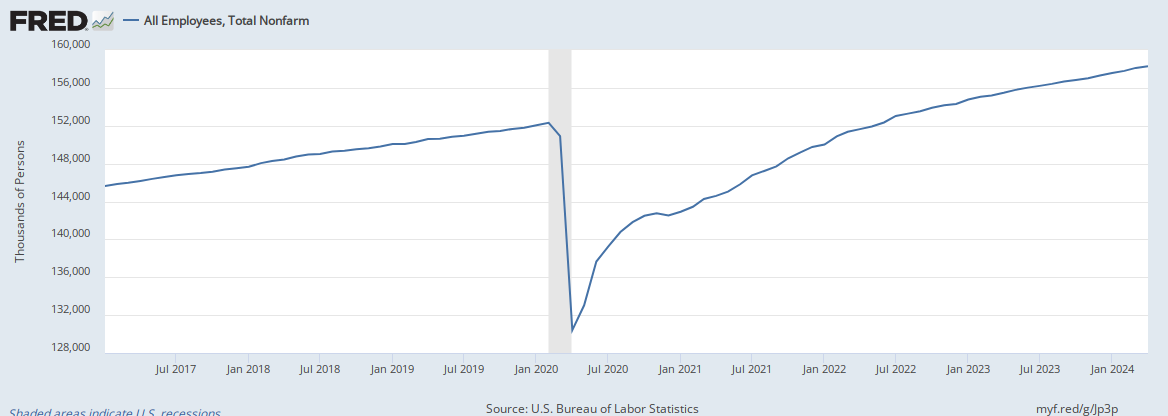

1) US payrolls

One of the most important measures of the economy, this number tells us how many jobs employers added each month. In a healthy economy, the US typically needs to add 100,000 to 150,000 jobs each month to keep up with population growth.

2) Unemployment rate

The unemployment rate is a key measure of pain in the job market. It counts workers who were unable to find a job even though they actively searched for one in the last four weeks, as percentage of the broader labor force.

3) Real gross domestic product

The broadest measure of economic activity — gross domestic product — measures the value of the goods and services produced in the country. It helps us understand the size of the economy and how it’s performing.

4) Debt-to-GDP

The debt-to-GDP ratio is a key measure of the government’s financial obligations. It measures how much money the federal government has borrowed from outside lenders, relative to the size of the country’s economy. As the ratio rises, it could be harder for the government to service its debt and afford future increases in spending.

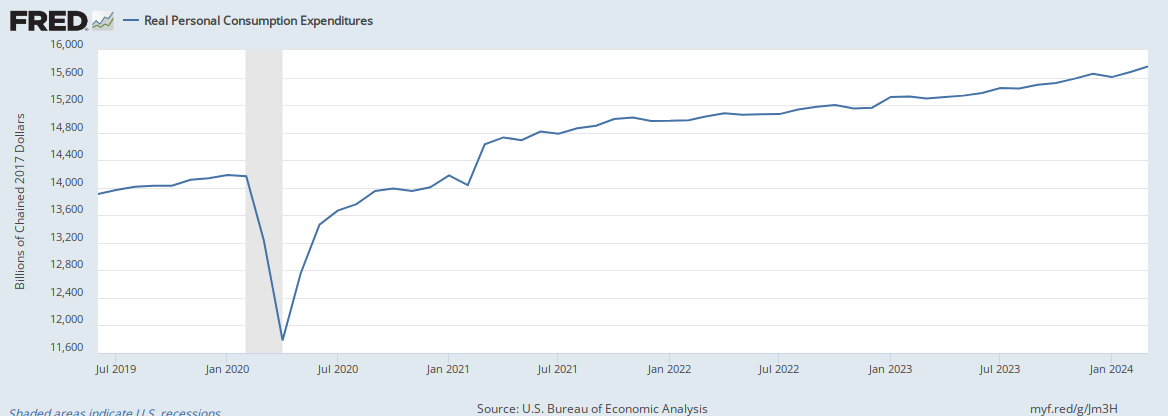

5) Consumer spending

Real personal consumption expenditures, also known as consumer spending, measures how much Americans spend on goods and services, adjusted for inflation. It’s an important measure because consumer spending is the biggest driver of US economic growth.

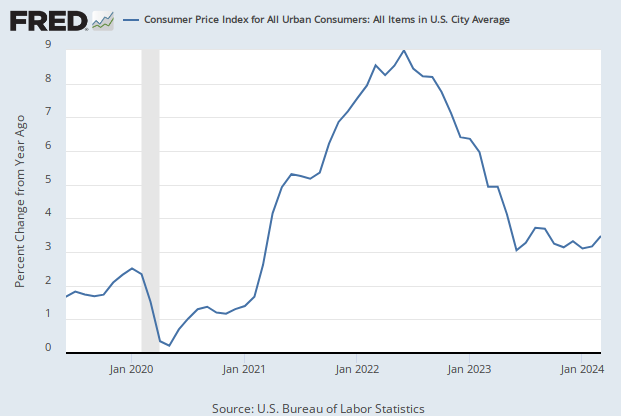

6) Consumer price index (CPI)

What’s the value of a US dollar? The Consumer Price Index is helpful in answering that question because it measures how prices change over time. It’s a key measure of inflation, calculated to include housing, food, gas, transportation and a wide range of other goods and services.

7) 10-year US Treasury rate

Movements in the 10-year Treasury rate can have a direct impact on consumers, influencing rates on mortgages, auto loans, student loans and credit cards. It’s also a key barometer of investor confidence. When investors expect stronger economic growth ahead, the 10-year rate will often rise. When they expect slow growth and low inflation, the rate will fall.

8) 30-year fixed mortgage rate

For most Americans, buying a home is the single largest purchase in a lifetime. The 30-mortgage rate tells us about the cost of borrowing to buy a home. It often falls when the economy is weak — in part because of the Federal Reserve’s efforts to stimulate the economy — and it usually rises when the economy is expected to strengthen.

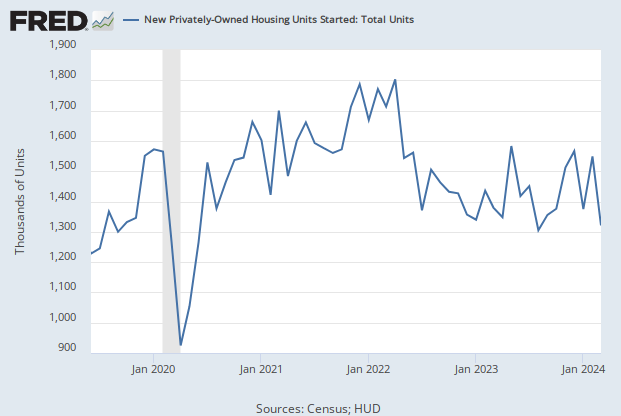

9) Housing starts

Housing starts are considered a “leading indicator,” signaling where the economy might be headed in the future. This measure counts the number of new homes or apartments being built every month, as construction crews break ground.

10) S&P/Case-Shiller US national home price index

This index tracks home values through purchase prices of existing single-family homes. It’s an important indicator of the wealth of Americans since, for most families, a home is their single most valuable asset.

11) Inventories to sales ratio

The inventories-to-sales ratio measures the amount of inventory businesses are holding, compared to the sales they’re fulfilling. When demand for goods is roughly as businesses had expected, the ratio barely changes — but when businesses stock up on either too much goods or too little, the ratio can swing in either direction.

12) S&P 500 index

One of the most closely-watched measures of the US stock market, the S&P 500 measures the value of 500 of the largest publicly-traded US companies. It’s weighted by market cap — meaning larger companies like Apple and Amazon carry more weight in the index than smaller companies.