Other Systems

Checks

- For most of the 20th century checks were the most common ways for people to make retail payments.

- In 2000, the Federal Reserve System had 45 check processing centers around the US => planes transported the checks every night to the correct processing center.

- Congress passed the Check 21 Act in 2003 allowing a picture of a check to represent a legal substitute of the original making check processing much more efficient. This, plus the general decline in check usage over the last 20 years has left the fed with only one check processing center today.

- Check processing is much cheaper for banks now => vast majority of check clearing arrangements are now electronic

- No longer possible to “float” a check as account debits are essentially same day

- Checks are now “truncated” by the depositor or the first depository institution using scanning equipment to capture both an image of the check and the MICR line printed on the bottom of the check.

Check Clearing Services

Mobile Payments (P2P Apps)

Big 3 P2P payment players are Paypal, Venmo, and Zelle…at least by this measure

- Paypal - 54% of consumers have used in past year

- Venmo - used by 14% of consumers in past year

- Zelle - used by 13% of consumers in past year Others include: Cash App & Google Pay, Apple Cash

Mobile Wallets - Paypal & Square have seen significant increases in the total amount of money stored on their mobile wallets, however individual accounts still hold relatively small amounts.

- Paypal worldwide funds @$31B

- Square (Cash App) worldwide funds $44B (faster growing than Paypal)

- Mobile payment providers trying to attract larger balances by offering expanded features and special deals on purchases made with stored funds.

- Zelle exists in part as a counter to these payment providers, banks depend on deposits

- Mobile payment providers are not banks …and therefore funds stored on these platforms are not FDIC insured …this will be meaningful to some => though generally skewed towards older generations

- 2.8 billion mobile wallet account worldwide as of end 2020, expected to increase to 4.8 billion by 2025

Three trends accelerating interest & usage of digital payment providers:

- Growth of ecommerce => turbo-charged by the pandemic

- Overall trend towards cashless payments => covid has probably accelerated this by 3-5 years

- Digital payment services expanding into payment processing functions normally done by banks & other payment providers

To preempt threat of competition digital payment firms are expanding their offerings into becoming a “super-app” for financial services.

- Paypal has launched buy-now-pay-later offering, cryptocurrency trading and credit-card services.

- Cash App (Square) has evolved into a digital bank (through partnerships) enabling users to buy bitcoin, trade stocks, receive paychecks and use a debit card

Leading Players

Paypal & Venmo

- Paypal combines an online wallet used by 350m consumers with a gateway accepted by 30m merchant => this generates large network effects which the firm has grown with various partnerships and product tie-ups.

- Venmo users can buy crypto with cash back earned from their Venmo credit card purchases <= automated purchases w/no transaction fee

- Through Paypal’s partnership with Paxos Trust Company <= A regulated provider

- Paypal checkout with crypto - allows online users to make purchases with their crypto by converting it to fiat (no transaction fees)

- Paypal’s market cap briefly eclipsed Mastercard’s in early 2021

- PayPal plans to create a “Super App” with a focus on payments, shopping, and financial services (checking, savings, investment, crypto, rewards) with these benefits:

- AI-powered money management: With all your data in one place, PayPal can help you make budgeting and investing decisions

- “Contextual Commerce”: With a purchase track record, PayPal can partner with merchants to give personalized offers and deals…

- Payment/transfer speed - depends on how the payment is processed on the backend:

- Transferring funds from a wallet balance to your bank can take up to a few days b/c ACH is used to send the funds - this is the free option

- Funds can be sent “instantly” within 30mins but it will cost you $10 or 1% of the transfer, whichever is lower

Zelle

- Money transfer service offered by most major US banks and credit unions to send money to other Zelle users through their bank account or the Zelle app

- Operated by Early Warning Services LLC, a company owned by several prominent US Banks

- Integrated with TCH’s RTP Network for real-time payments

- If payee or payor’s FI is not connected to the RTP network transfers will instead settle in minutes via Zelle’s network

- Can only send money to US bank accounts

- Free to use => Zelle is the banking industry’s response to other P2P payment providers like Paypal & Venmo. By offering free and fast P2P payments, banks hope to keep end user deposits in-house instead of seeing those deposits transferred out of the banking system and into another payment network.

- Increasingly being used for B2B payments

- Q3 2020 => 323 million transactions worth $84 billion

- Now the country’s most widely used money transfer service (free, fast, & convenient => embedded in banking apps), $490B sent through Zelle last year compared to $230B through Venmo (its closest rival)

- Issue: Fraud has been flourishing on Zelle. …the banks know this but have not built protections against this or are not refunding the fraudulent transactions. The argument goes something like: “Payments through Zelle have to be authorized by the sender, and since the sender authorized a payment to a fraudster there wasn’t fraud” ..at least from the bank’s perspective => the banks are conveniently relying on a federal law covering electronic transactions that requires them to only cover “unauthorized” transactions. …it’s a bit of a cop out, but the industry also hasn’t come up with a good way deal with fraud on these platforms yet. One may be tempted to say something like “well any transaction that was fraudulently misrepresented should be reversible”* …but deciding who/what is the arbiter of what is or isn’t fraud is part of the problem here. Right now, money senders are the only victims of fraud. Creating an ill thought out solution could potentially open the door to money recipients being victimized later (ie through fraudulent clawbacks).

Square

- Targets independent merchants and consumers under-served by conventional banks, operates a similar model to Paypal.

- Building products to cater to larger sellers: ex inventory management tools

- Also accepts ACH payments on Square Invoices - likely to appeal to larger sellers => processing fee of 1%

Other Companies

- Adyen and Stripe are pure online acquirers with no consumer brand. But their platforms makes it fast and easy for

businesses to set up online-payment platforms.- Stripe has long served smaller firms

- Adyen typically serves big firms

Apple Pay

Topics:

- The process to add a new payment card to Apple Pay

- How Apple Pay works as a payment method

- Apple Pay’s value to Apple

The process to add a new payment card to Apple Pay

- When you scan your card or enter the details manaually, the Apple Wallet App does the following in the backgroundD:

- The Payment Card’s Primary Account Number (PAN), along with other card based information (your name, card expiration date) is sent to the Apple Pay Servers.

- The Apple Pay server ID’s your card’s Issuing Bank by the PAN and then passes the card information to the bank to request a Payment Token

- The Issuing Bank calls a Token Service Provider (TSP) to request the Payment Token.

- TSP’s are entities that must be registered with EMVCo as a TSP.

- The TSP vaults the PAN, generates a Payment Token, and associates the new Payment Token with the PAN.

- The TSP then sends the Payment Token (along with a Payment-Token-Key …the public key) to the Issuing Bank.

- The Issuing Bank receives the Payment Token & Payment-Token-Key and adds it’s own CVV-Key (another public key to the mix).

- The Issuing Bank returns the 1) Payment Token, 2) Payment-Token-Key, 3) CVV-Key back to Apple Pay servers.

- Apple Pay uses it’s own Trusted Service Manager (TSM) and provisions the three data elements from step 6 (and other data) onto the “Secure Element” - the secure hardware chip on your device => This is the payment token Apple saves on the SE and calls the DAN (Device Account Number).

How Apple Pay works as a payment method - (Also see the basic credit card processing flow)

- Authenticate yourself with the device (via fingerprint, face ID, or PIN) to begin the process. This allows Apple Pay to access information stored in the device’s Secure Element (SE).

- The SE then performs the following steps:

- Generates a Dynamic Cryptogram (aka One-time Unique Number) - a combination of the Payment Token, transaction amount, transaction counter w/Payment-Token_Key (public key provided by TSP)

- Generates a Dynamic CVV (aka Dynamic Security Code) - using the public key provided by the Issuing Bank

- Passes the Payment Token (DAN), Dynamic Cryptogram, Dynamic CVV Value, and other payment and chip data elements to the POS terminal via NFC using EMVCo’s contactless specifications.

- POS sends request to Acquirer’s Bank which forwards to the Payment Network

- The Payment Network uses BIN Tables to ID the request as Payment Token instead of a real PAN and routes the Payment Token & Dynamic Cryptogram to the TSP => which then provides the associated real PAN after validation.

- TSP receives Payment Token (DAN) & Dynamic Cryptogram. Validation is performed by deciphering the Dynamic Cryptogram (which contains the public Payment-Token-Key) using the private Payment-Token-Key. If properly validated, the real PAN is retrieved from the Token Vault and sent to the Payment Network.

- The Payment Network receives the real PAN and send the PAN, with transaction details & the Dynamic CVV to the Issuing Bank for authorization.

- Issuing Bank uses the Dynamic CVV (using it’s private key) to validate the request. Checks customer’s credit balance against the transaction amount and authorizes the request.

- The issuing bank returns the “authorization request” back to the Payment Network, which passes it back to the Acquiring Bank, which sends it to the POS terminal, which uses NFC to send to your device that the transaction was approved.

Steps 1-8 happen in a matter of seconds.

Apple Pay’s value to Apple

- Apple receives 0.15% of the roughly 1.7% interchange fee received by the Issuing Bank - they are willing to pay it b/c they are guaranteed a secure transaction that is initiated though Apple Pay

- Keeps users engaged & dependent on Apple devices

- Another moat for Apple to expand and defend

In the News

- Contactless Payments coming late 2022

- Tap to pay on iPhone - can conduct secure credit card transactions directly between two iPhone devices => good for small businesses, possibly long term decline on standalone POS terminals….curious to see if this eventually expands to support for non-iphone digital wallets ….already will work with contactless credit/debit cards…

- Looks like apple’s investment in Mobeewave is paying off ….may have been a bargain price

- Tap to pay on iPhone - can conduct secure credit card transactions directly between two iPhone devices => good for small businesses, possibly long term decline on standalone POS terminals….curious to see if this eventually expands to support for non-iphone digital wallets ….already will work with contactless credit/debit cards…

Ripple

- A Payment Network (RippleNet) designed to make gloabal payments faster, more efficient, and transparent

- Connects banks, payment providers, and corporations … “hundreds of FI’s” around the world via single API

- Blockchain based platform to enable low cost real-time messaging and transaction settlement

- Targeted at cross-border/international payments => think alternative to SWIFT

Starbucks App

Mobile app used to buy Starbucks drinks, foods, and retail offerings in store or by ordering ahead. Essentially a prepaid card used to draw down a Starbuck’s balance. It can be replenished with cash in a store or through a connected credit card.

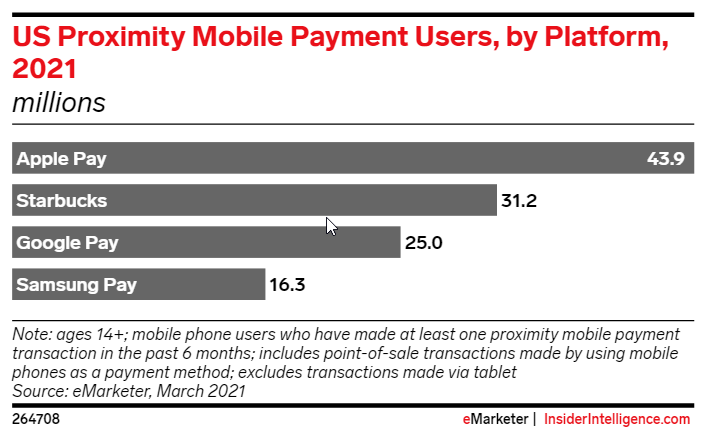

- 2nd place ranking among mobile payment solutions, impressive considering volume is almost entirely for coffee and related products …kinda crazy actually …this is essentially a closed loop prepaid card, the others are not. Must be nice to have such sticky/inelastic demand

- Interesting that so many coffee drinkers have switched to the app… would be interesting to see percentage of starbucks app users using other digital wallets regularly…

Also Noteworthy:

- Starbucks has roughly $1.6 billion in “stored value card liabilities” => these are prepaid card balances which is essentially free debt to Starbucks. These are loans to Starbucks that it does not have to pay interest on. Nice deal for them and represents cash the company can immediately apply to fund operations!

- Also - each year a portion of this balance is recognized permanently lost (or unused), this is called breakage. This can be as much as 10% and is recognized as profit …which implies a negative interest rate on that free debt.

Gift Cards

Specialized payment cards, treated as cash, and produced to work under two models:

- Closed-loop gift cards => are the traditional retailer issued card (ex. a Starbucks gift card). These can only be used to purchase the retailer’s goods or services.

- Open-loop gift cards => often issued by the likes of Visa and American Express. They therefore use the payments network and are essentially a prepaid card that can be used anywhere credit/debit cards are accepted.

Gift cards are essentially another form of private money.

- Gift card exchanges exist where users can swap/sell unwanted cards for cash

- Most gift card have extremely long expirations which makes them tend to hold value in these marketplaces/exchanges

- Most issuers provide a website to check gift card balances - independent balance verification makes these viable in a marketplace/exchange context

Why gift cards are so ubiquitous (every business offers them):

- They excel at achieving the 3 goals of marketing:

- Bring in new users

- Bring users back

- Increase basket sizes

- They provide businesses with “float”

- Similiar to the Starbucks example above….gift cards represent a kind of non interest bearing loan to the company. …until the “loan” is has to be paid back (ie the customer uses the gift card) the company has cash on hand to essentially use however it wants.

- Breakage - A certain percentage of all gifts will be lost or go unclaimed. After a few years companies can recognize a percentage of this (~2-4%) and recognize the revenue. This becomes FREE MONEY.

Other

- Cash => see section on Money

- Money Order - A paper document, like a check, issued by a third party and used as a payment instrument.

- Maximum limit typically at $1k per order

- Can be purchased at US post offices, banks and credit unions, and other “money cashing” stores.